Know Your Customer, Know Your Competition

by:

Dave Archer | Principal Engineer

Peak Innovations Engineering

9934 N. Alpine Rd., Suite 104

Machesney Park, IL 61115 USA

Every supplier has the opinions of their customers and what motivates them to buy. Success in meeting economic goals is always dependent on the accuracy of those views. The following is one view of what makes the product development engineer tick. Of course, the first question is whether engineering or procurement is your real customer. Ultimately, it is either one or the other and much more often than not it is the engineer. However, engineers often abdicate their decision out of apathy or fear, making it appear you are stuck with a low-bid situation more often than is actually the case. If you are not sure, just ask an engineer. They will tell you. There are some good reasons why procurement does not want you to talk to their engineers without a chaperone.

We are usually not the best business people. Of course, make sure you know whether it is the engineering manager or procurement that’s the barrier. If it is the engineering manager, the observations that follow still apply. Like everyone else, the workload is one of the engineer’s biggest complaints. In nearly all your interactions you will be saving your customer time or you will be asking your customer to invest time in you, constantly ask yourself which you are doing. For example, every supplier constantly complains they never get in on a program early enough. The most common reason for this is the supplier is not bringing enough benefits at that time for the engineer to invest time in explaining their needs. Forwarding a drawing or parts list for quotation a few months later is much easier.

Partly because of workload and partly due to the relentless short-term focus on next quarter’s results, many engineers are becoming more risk-averse. If you are getting push-back in trying to place a new application because your contact has technical concerns, to be successful these concerns need to be addressed to his satisfaction, however unreasonable that might appear to be. You need data or hardware as your assurances are not addressing his concerns. The most valuable weapons, in decreasing order of effectiveness:

- Find the same component successfully fielded in the same application. Even if the application is your competitor’s product, this approach has more potential benefit than harm unless the competitor has a clear differentiation or pricing advantage. The key is that the customer perceives it as the same application (thus mitigating their risk) as opposed to whether it is the same fastener.

- Take it upon yourself to test the application, preferably from an independent source. The customer will say it’s OK if you test it yourself. What they will not tell you is that they will question the credibility of any positive result, largely negating the benefit of your investment. This is particularly true in industries where engineers are not familiar with joint testing. In any case, forward the test procedure to the decision-maker for an informal approval before you start. Forwarding the request by e-mail is a documented but non-threatening way to make it more difficult for the engineer to ignore or downplay the benefit of positive results.

- The last resort is to decrease the perceived risk of your product by increasing the perceived risk of any alternative.

This can be effective if you are focusing on the potential customer’s concern; technical risk. Telling him that your competitor’s rep is dumb, never delivers, has a 37 handicap, and cheats on his wife might be interesting (and might even be true), but it is not going to get you the sale. Neither is relating third party dissatisfaction. Getting existing test results, warranty or recall data, obtaining testimonials from experts such as an independent service organization, or commissioning an independent competitive test will all help level the playing field. Forwarding feedback from industry technical forums is an effective means of making your point. Just make sure you run a search to be sure your product is not being harpooned in a thread somewhere else on the site.

While these observations might provide food for thought on an individual organizational basis, they do not address the biggest challenge to the industry comes from outside, not from fastener manufacturers overseas.

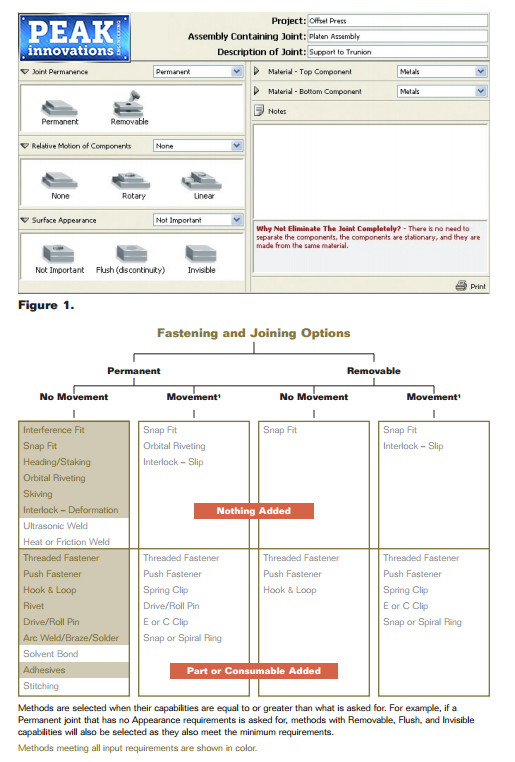

Figure 1 is a screenshot of a selection guide on our web site showing potential fastening and joining applications by joint requirement. One of the challenges of the fastener industry is their products are used in applications where other options are very viable alternatives. For example, many threaded fasteners are used in joints not intended to come apart. Why? Often it is not because it is the most cost-effective solution. It is because bolts are familiar, available, and do not require a lot of time or investment to implement. Many people do not trust bonded joints because they had them fail in the past. Just like 30 years ago everyone had war stories about how the plastic parts in their car cracked and fell off. Do you want all that metal back in your car now? Adhesives, like thermoplastics, can be modified more easily for specific applications than formed metal and chemical companies have the budget for customer education and testing. New more insensitive adhesives to surface conditions and others with innovative cure mechanisms are making significant inroads.

Also, consider the utility of any attachment method is dependent on the materials and manufacturing process of the components it secures. As more low-density metals and composites are introduced, new joint designs will be required because the material properties demand it. At that point, it takes just as much effort to look at alternatives as it does to rethink how to make the existing fastener work. I think the solution is for this traditionally fragmented industry is to form coalitions that do more than develop standards. There are some compelling success stories of industry consortiums whose mandate is growing their market through innovation. One of the most impressive has parallels to the fastener industry. What is another product saw as decidedly low-tech, low growth, and 20th century? How about steel? Yet the UltraLight Steel Auto Body (ULAB) project, funded by a consortium of 33 steel producers, demonstrated through a comprehensive combination of analysis, testing, and prototyping advanced high strength steels could compete quite well with aluminum, magnesium, and composites.

Because of this 2002 report, and the knowledge that arose from it, applications that would have otherwise been lost to other materials are still steel. Of course, the return on this type of investment can be debated; the industry has survived without it. With that in mind, perhaps it is appropriate to quote a Chinese proverb, which loosely translated warns, “If you continue on your current path, you will get to where you are going.”

Company Profile:

Peak Innovations Engineering has a highly technical team to design, test, validate, and enhance the bolted joints within your product application. Joint development and testing are all we do, so we do it better than other available options, both internal and external. Why consume your resources engineering and problem-solving areas that are secondary to your core responsibilities when we can take care of them quickly, definitively, and cost-effectively? www.pieng.com